Make way for a reliable and powerful workforce

Be sure about the best candidates with Smartikcs swift, compliant, and secure background checks.

Be sure about the best candidates with Smartikcs swift, compliant, and secure background checks.

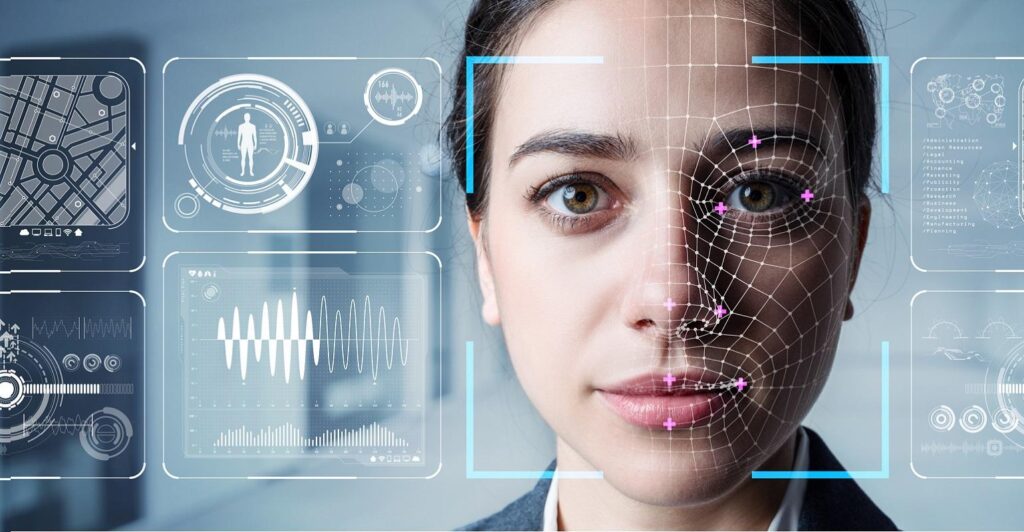

Smartikcs > KYC Solutions for Instant Identity Verification

Leverage an AI-powered KYC Solution to revolutionize your customer identification process. Enhance efficiency, accuracy, and compliance standards by harnessing advanced technology to streamline and optimize your KYC procedures, ensuring robust customer due diligence practices.

Traditional KYC processes provide a broken KYC experience owing to repetitive data submissions and manual processes.

Organization often struggle with infrastructure constraints to provide comprehensive KYC support for multiple identity and document types

Staying compliant in the constantly evolving regulatory and compliance landscape poses a daily challenge for organizations

Our AI-powered KYC solutions uses liveness detection technology to determine and validate customer’s identity in real-time. It does so by comparing user’s live image with the uploaded national identity document using biometric anti-spoof algorithms. In this way, Digital and Video KYC helps in mitigating the risks of identity thefts and financial frauds before onboarding customers in banks, NBFCs, mobile wallets, gaming, e-commerce and P2P marketplaces.

Our Digital and Video KYC solutions enable instant verification with the power of AI, ML, and deep search algorithms ensuring the fastest onboarding process for your customers, helping you in reducing account activation turnaround time while also reducing operational costs, helping your organisation scale up at speed. Automating KYC also means you can go-to-market much faster while also reducing operational costs.

Get in-depth analysis and audited reports with each initiated case and track the progress of cases in bulk. Our KYC solutions are data security compliant and adhere to the global standards of data privacy, which means you can stay on top of the regulatory compliance framework.

Provide us with some information about your company, and a representative will get in touch with you soon to go over the best screening options for your requirements.

© 2024 — Website Maintained By NorthoTech Solutions LLP.